Advanced Tax Fraud Analytics

AI powered advanced analytics solution reduces Tax fraud across the most complex ecosystems

Easily integrated with systems in use by Tax Authorities

The Issue: Many countries collect far less tax than is due to them

- These loses, often 20% of its potential receipts because of Fraud, Evasion and Avoidance

- Professional cartels use Cross border trades, complex carousel schemes and falsification of sales records to evade a countries fraud detection capabilities

- Many countries’ national tax departments adopt better digital techniques to improve the situation

Key Challenges to automated Tax fraud detection and prevention

- Tax authorities lack proper integrated fiscal information environments

- The inability to ingest and analyze large, complex tax data sets

- Lack of enforcement resources to police ever more sophisticated schemes

- Lack holistic data from company registers and citizen information for forensics analysis and audit

mLogica has the solution!

mLogica’s CAP*M AI Powered Tax Fraud Advanced Analytics Makes the Difference

Avoid non-recording of trade

Avoid non-recording of trade Addressing tax fraud and evasion

Addressing tax fraud and evasion Suppressing grey economy

Suppressing grey economyPre-Built and Customized Analytics to Meet Agency Requirements

COMPONENTS OF TAX FRAUD ADVANCED ANALYTICS

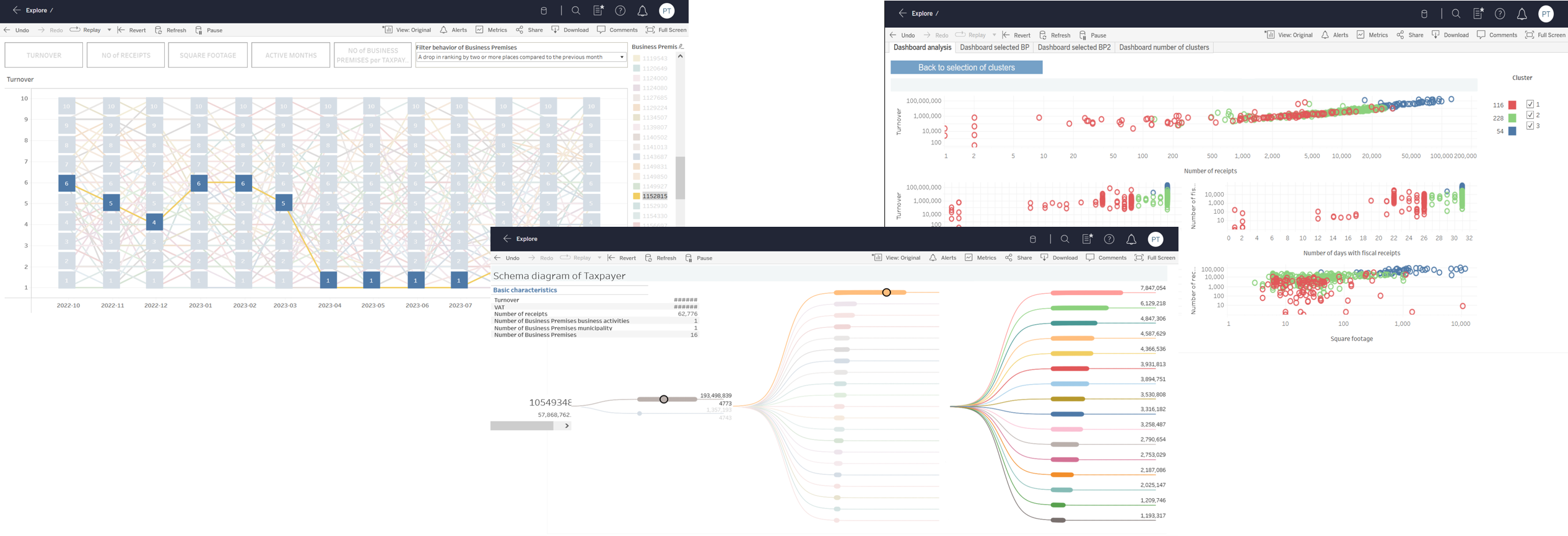

Forensics & Audit

- Efficient Visualization

- Access to trillions of transactions in seconds

Alerts and Reporting

- Live Tax threat Alerts

- Automatic reporting to stakeholders including other agencies and partner countries

Enforcement Efficiency

- Best use of available Human, Financial and technology resources

All data in one place

- Tax transactions and history

- 3rd party supplier chain data

AI powered Advanced Analytics

- Real time monitoring transactions

- Risk of fraud and anomaly detection

Blend Outside Source Data

- Holistic view from 3rd party sources

- Network mapping

Combat Tax Fraud. Increase Revenue. Get Your Free Assessment.

CAP*M, mLogica’s Complex Events Analytics platform, powers solutions across industries from finance and defense to agriculture and transportation. Scalable, adaptable, and precise, it transforms complex data into real-time intelligence for smarter decisions.