VAT Fraud Analytics

CAP*M VAT Fraud Analytics Application

Preventing VAT tax fraud can save countries billions worldwide—but how can so many complex, multi-national VAT Fraud Analytics be monitored effectively?

mLogica’s CAP*M VAT Fraud Analytics monitors retail VAT collection at all touchpoints

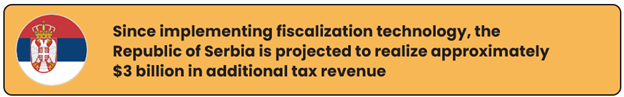

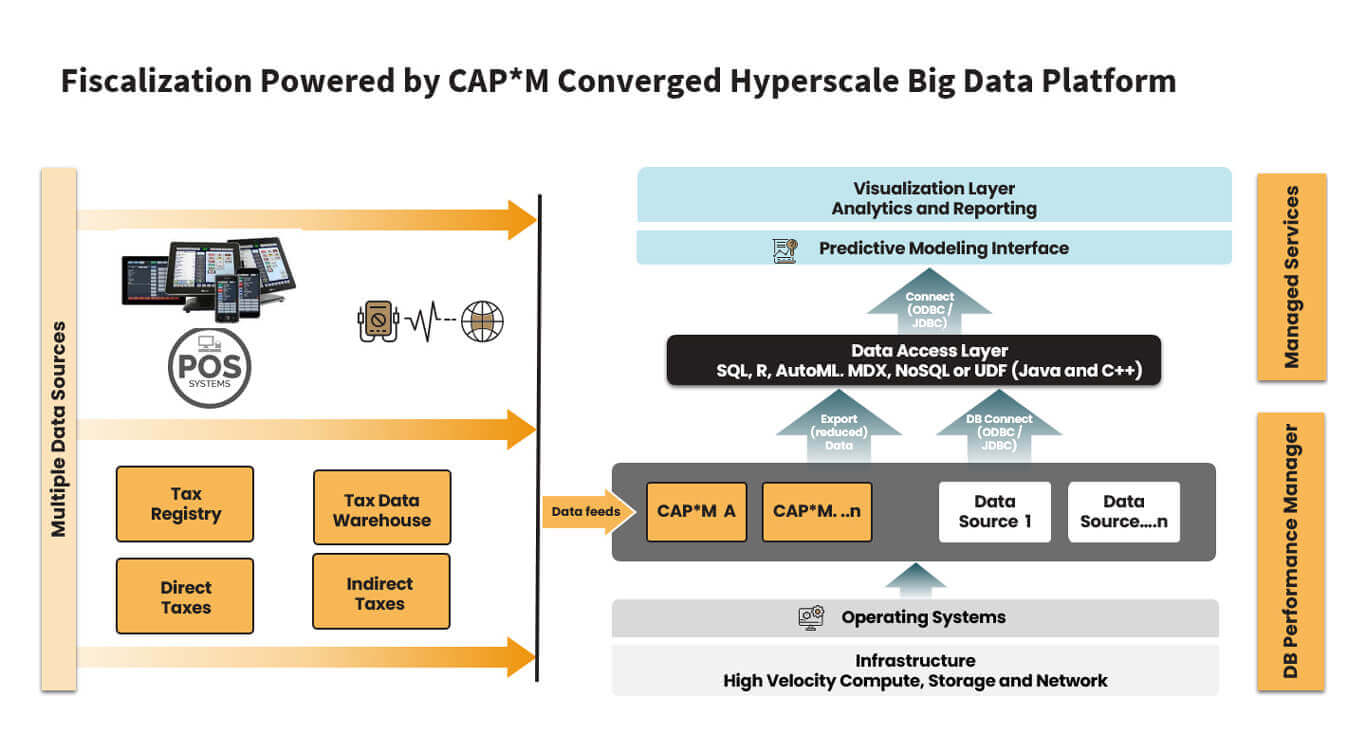

Designed to prevent tax fraud across the most complex ecosystems, our CAP*M VAT Fraud Analytics application is easily integrated with fiscalized and non-fiscalized systems already in use.

Combat Fraud, Drive Tax Enforcement and Enhance Revenue

According to the European Commission, EU member states lose €134 billion in VAT revenues annually due to fraud. Whether this originates from falsification of sales records or carousel schemes, unscrupulous merchants and professional thieves are continuously evolving their tactics to stay ahead of governmental fraud detection capabilities.

Key Challenges Blocking Effective Fiscalization:

- Value-added tax (VAT) is applied in more than 160 countries worldwide

- Levied on the price of retail products and services at each stage of production, distribution or sale, VAT is uniquely vulnerable to fraud

- Lack of process automation and solutions to provide secure transactions

- Absence of comprehensive, efficient taxpayer self-service options

- Tax authorities lack integrated fiscal information environments and the technology to manage complex, hyperscale tax data sets

CAP*M VAT Fraud Analytics lets you leverage big data for real-time VAT tax transaction analysis

mLogica’s CAP*M VAT Fraud Analytics identifies legitimately-paid VAT taxes, detects instances of VAT evasion and ensures valid refunds are credited to the proper entity, saving government and businesses worldwide billions.

mLogica’s CAP*M VAT Fraud Analytics application makes the difference

- Our complete stack solution features a fully-integrated fiscal information system, including database, application, back-end and tax authority portal, while our unified register of taxpayer information provides:

- Plug-ins for connections to external government institutions such as Business Register, Central Bank, Registrar of Citizens, Registrar of Property and more

- Historical data on all taxpayer transactions

- Comprehensive model for authorizing taxpayer information access

- On- and off-line transactions secured by public key infrastructure (PKI) encryption and cybersecurity framework

- An advanced analytical platform that can be fully integrated within the tax authority information ecosystem

- CAP*M VAT Fraud Analytics is a comprehensive solution, offering models and technical workflows that easily facilitate expansion and ongoing tax ecosystem integrations